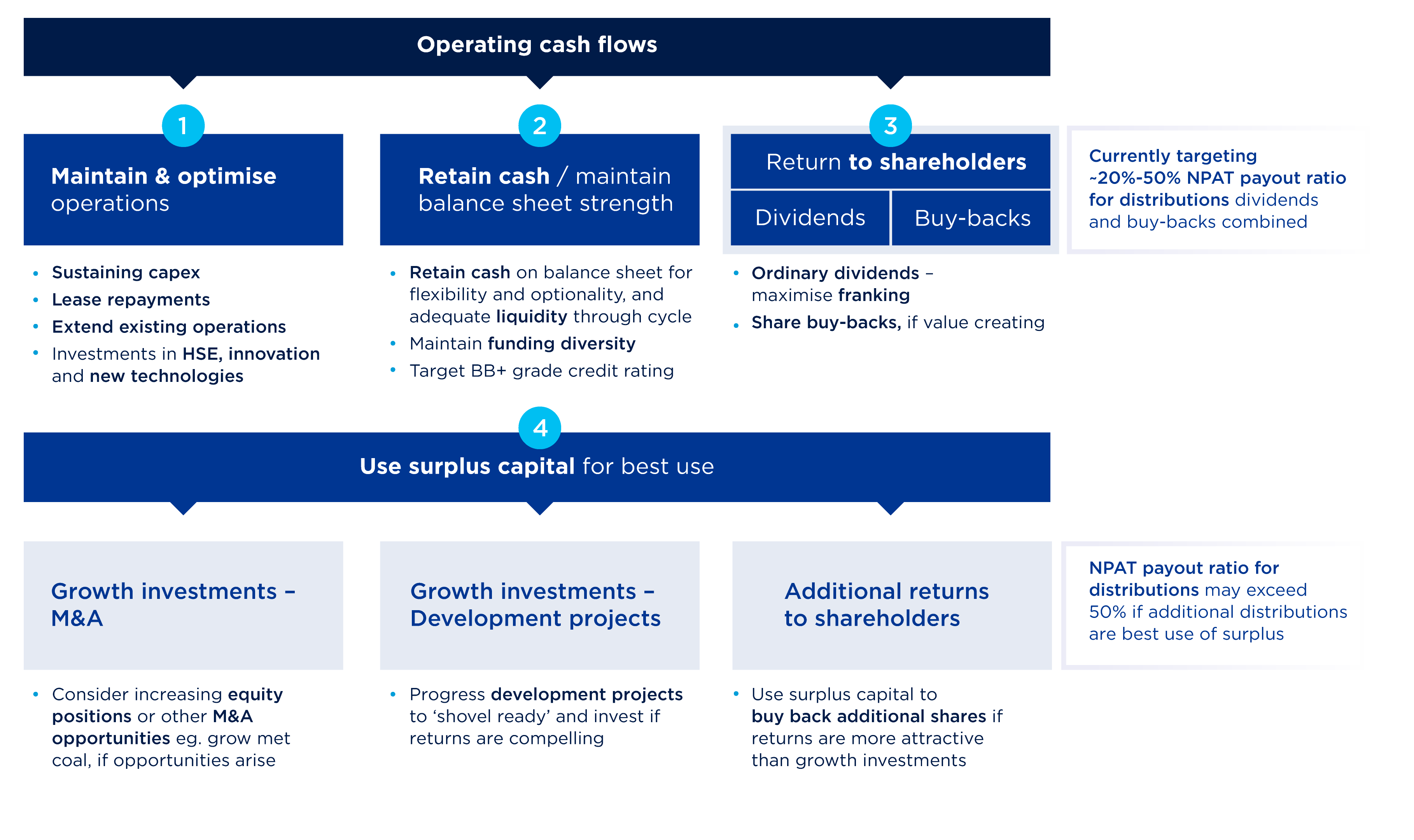

Capital allocation framework

Since 2022, Whitehaven Coal has adopted a clear capital allocation framework to help maintain balance sheet resilience and deliver shareholder value.

Important Note:

On 18 October 2023, Whitehaven announced the acquisition of BMA’s Daunia and Blackwater coal mines. An update was provided on the application of Whitehaven’s Capital Allocation Framework to take into account current priorities as a result of the acquisition. This update can be found on slide 35 of the acquisition presentation released to the ASX on 18 October 2023. Refer here to Whitehaven’s ASX Releases.

Dividend information

7c fully franked 2024 Interim Dividend

Whitehaven announced that it will pay a 2024 Interim Dividend of 7 cents per ordinary share fully franked on 8 March 2024.

42c fully franked 2023 Final Dividend

Whitehaven announced that it will pay a 2023 Final Dividend of 42 cents per ordinary share fully franked on 15 September 2023.

Key dates

| Event | Interim Dividend FY2024 | Final Dividend FY2024 |

|---|---|---|

| Ex-dividend date | 22 February 2024 | – |

| Record Date | 23 February 2024 | – |

| Payment Date | 8 March 2024 | – |

| Dividend per share (AUD) | 7 cents | – |

Dividend history

| Dividend date | DPS | Franking | Type |

|---|---|---|---|

| Mar-24 | $0.070 | 100% | ordinary |

| Sep-23 | $0.420 | 100% | ordinary |

| Mar-23 | $0.320 | 100% | ordinary |

| Sep-22 | $0.400 | 100% | ordinary |

| Mar-22 | $0.080 | 0% | ordinary |

| Sep-21 | - | ||

| Mar-21 | - | ||

| Sep-20 | - | ||

| Mar-20 | $0.015 | 0% | ordinary |

| Sep-19 | $0.130 | 50% | ordinary |

| $0.170 | 0% | special | |

| Mar-19 | $0.150 | 0% | ordinary |

| $0.050 | 0% | special | |

| Sep-18 | $0.140 | 0% | ordinary |

| $0.130 | 0% | special | |

| Mar-18 | $0.130 | 0% | ordinary |

| Nov-17 | $0.060 | 0% | shareholder distribution – dividend component |

| $0.140 | - | shareholder distribution – capital return | |

| Sep-17 | - | ||

| Mar-17 | - | ||

| Sep-16 | - | ||

| Mar-16 | - | ||

| Sep-15 | - | ||

| Mar-15 | - | ||

| Sep-14 | - | ||

| Mar-14 | - | ||

| Sep-13 | - | ||

| Mar-13 | - |

How to update your dividend information / instructions

To update your shareholder information or dividend instructions please contact Whitehaven’s Share Registrar Computershare, via:

- website: www.computershare.com.au/easyupdate/WHC

- email: info@computershare.com.au

- phone (during business hours): 1300 850 505

- mail: Computershare Investor Services Pty Limited

GPO Box 523

Brisbane QLD 4001

Share buy-back

On 17 February 2022, Whitehaven announced that it would undertake a share buy-back of up to 10% of shares over a twelve month period, which commenced on 7 March 2022. Share buy-back activity has continued.

Announcements in relation to Whitehaven’s share buy-back activities can be found here under ASX Announcements. You can put ‘buy back’ in the Search line to readily find relevant notifications.

On 18 October 2023, Whitehaven announced the acquisition of BMA’s Daunia and Blackwater coal mines. Page 4 of the announcement includes an update on capital returns to shareholders – it is expected the share buy-back will remain on hold during the deferred payment period, and the Board will make a decision regarding resumption of the buy-back at the appropriate time.

With 1,032,644,232 shares on issue at the start of the buy-back program in March 2022, buy-back activity is summarised below:

Initial 10% share buy-back from 7 Mar-2022 to 21 Oct-2022

| Shares bought back | Capital returned via buy-back | |

|---|---|---|

| 103,264,423 | 10.0% | $587.9m |

Share buy-back since 26 Oct-2022

Last updated: 10 July 2023

| Shares bought back | Capital returned via buy-back | |

|---|---|---|

| 92,779,025 | 9.0% | $723.6m |

Buy-back activity is summarised below on a financial year basis,

including capital returned to shareholders via dividends.

Last updated: 1 July 2023

| Shares bought back |

Capital returned via buy-back | Capital returned via dividends | Total capital returned to shareholders |

|

|---|---|---|---|---|

| FY2022 | 76,372,580 | $362.6m | $79.8m | $442.4m |

| FY2023 | 119,670,868 | $948.9m | $638.8m* | $1,587.7m |

*Includes payments of the FY22 final dividend and the FY23 interim dividend.

The allocation of capital to buying back shares takes into account the Company’s targeted payout ratio of 20-50% of NPAT for dividends and buy-backs combined, to ensure appropriate capital is allocated between buy-backs and dividends.

If there is capital available to buy back shares and the Board considers it value accretive for shareholders, there are a number of additional contributing factors that determine whether the company is active in the market on any day. Our Securities Trading Policy outlines periods when we do not trade Company Securities, including during blackout periods, which are outlined in Clause 15.

Other factors that influence whether the company is active in the market include, but are not limited to the following:

- Daily volumes are always considered with respect to not moving the market, and shares cannot be bought back if the market price exceeds 5% of the previous 5-day VWAP.

- Timing of ex-dividend and dividend record dates.

Whitehaven’s Security Trading Policy can be found at

www.whitehavencoal.com.au/our-business/corporate-governance/

Shares on issue

Whitehaven regularly issues a Cessation of Securities notice to the ASX to cancel shares that the company has bought back via its on market share buy-back program.

You can find the latest shares on issue by going to our ASX announcements page and searching for ‘cessation of securities’. This will bring up the latest notification to the ASX.

As at 10 July 2023, ordinary shares on issue: 836,600,784.

Within the ordinary shares on issues there are 34.02 million WHC shares on issue that are restricted milestone shares. These shares were issued as part of the acquisition of Boardwalk Resources Pty Ltd in 2012. The milestone shares are subject to contractual restrictions on voting and transfer, and currently are not entitled to receive distributions (Restrictions).

Important Information

Material on this page is intended only for general information and Whitehaven Coal makes no warranty as to the accuracy of this information. The material is not intended to be relied on as a substitute for your own research. We do, however, welcome your feedback and suggestions concerning any of the material. Please contact KFitzGerald@whitehavencoal.com.au

Whitehaven coal

Whitehaven coal