Capital allocation framework

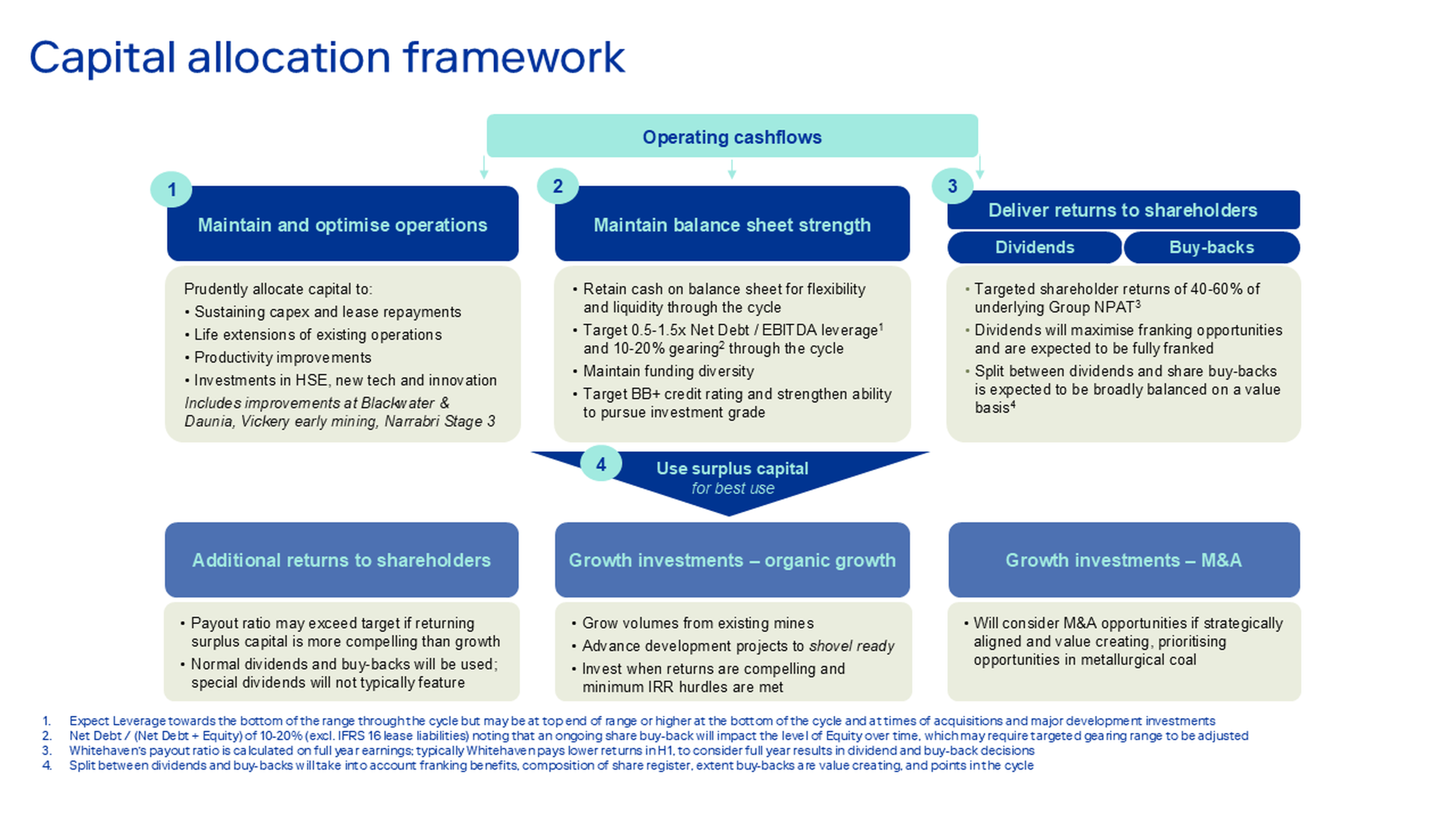

Since 2022, Whitehaven Coal has adopted a clear capital allocation framework to help maintain balance sheet resilience and deliver shareholder value.

The framework was refreshed in August 2025 and is set out below.

Dividend information

6c fully franked 2025 Final Dividend

Whitehaven announced that it will pay a 2025 Final Dividend of 6 cents per ordinary share fully franked on 16 September 2025.

9c fully franked 2025 Interim Dividend

On 14 March 2025, Whitehaven paid a 2025 Interim Dividend of 9 cents per ordinary share fully franked.

Key dates

| Event | Interim Dividend FY2025 | Final Dividend FY2025 |

|---|---|---|

| Ex-dividend date | 27 February 2025 | 3 September 2025 |

| Record Date | 28 February 2025 | 4 September 2025 |

| Payment Date | 14 March 2025 | 16 September 2025 |

| Dividend per share (AUD) | 9 cents | 6 cents |

Dividend history

| Dividend date | DPS | Franking | Type |

|---|---|---|---|

| Sep-25 | $0.060 | 100% | ordinary |

| Mar-25 | $0.090 | 100% | ordinary |

| Sep-24 | $0.130 | 100% | ordinary |

| Mar-24 | $0.070 | 100% | ordinary |

| Sep-23 | $0.420 | 100% | ordinary |

| Mar-23 | $0.320 | 100% | ordinary |

| Sep-22 | $0.400 | 100% | ordinary |

| Mar-22 | $0.080 | 0% | ordinary |

| Sep-21 | - | ||

| Mar-21 | - | ||

| Sep-20 | - | ||

| Mar-20 | $0.015 | 0% | ordinary |

| Sep-19 | $0.130 | 50% | ordinary |

| $0.170 | 0% | special | |

| Mar-19 | $0.150 | 0% | ordinary |

| $0.050 | 0% | special | |

| Sep-18 | $0.140 | 0% | ordinary |

| $0.130 | 0% | special | |

| Mar-18 | $0.130 | 0% | ordinary |

| Nov-17 | $0.060 | 0% | shareholder distribution – dividend component |

| $0.140 | - | shareholder distribution – capital return | |

| Sep-17 | - | ||

| Mar-17 | - | ||

| Sep-16 | - | ||

| Mar-16 | - | ||

| Sep-15 | - | ||

| Mar-15 | - | ||

| Sep-14 | - | ||

| Mar-14 | - | ||

| Sep-13 | - | ||

| Mar-13 | - |

How to update your dividend information / instructions

To update your shareholder information or dividend instructions please contact Whitehaven’s Share Registrar Computershare, via:

- website: www.investorcentre.com/au

- email: [email protected]

- phone (during business hours): 1300 850 505

- mail: Computershare Investor Services Pty Limited

GPO Box 523

Brisbane QLD 4001

Share buy-back

Share buy-backs are a feature of Whitehaven’s Capital Allocation program.

Announcements in relation to Whitehaven’s share buy-back activities can be found here under ASX Announcements. You can put ‘buy back’ in the Search line to find relevant notifications.

On 7 March 2022, Whitehaven commenced its share buy-back program. The share buy-back was paused in FY2024, during the acquisition of BMA’s Daunia and Blackwater coal mines. Following the sell-down of 30% of Blackwater, the buy-back resumed.

Buy-back activity is summarised below on a financial year basis, including capital returned to shareholders via dividends. With 1,032,644,232 shares on issue at the start of the buy-back program in March 2022, the percentage of shares acquired and cancelled through the buy-back program is captured below.

Last updated: 30 July 2025

| Shares bought back | Capital returned via buy-back | Capital returned via dividends | Total capital returned to shareholders | Cumulative % of shares bought back | |

|---|---|---|---|---|---|

| FY2022 | 76,372,580 | $362.6m | $79.8m | $442.4m | 7.4% |

| FY2023 | 119,670,868 | $948.9m | $638.8m1 | $1,587.7m | 19.0% |

| FY2024 | Share buy-back paused due to QLD acquisition | $391.9m2 | $391.9m | ||

| FY2025 | 4,176,977 | $23.0m | $176.2m3 | $199.2m | 19.4% |

-

-

-

- Includes payments of the FY22 final dividend and the FY23 interim dividend.

- Includes payments of the FY23 final dividend and the FY24 interim dividend.

- Includes payments of the FY24 final dividend and the FY25 interim dividend.

-

-

During share buy-backs, there are a number of contributing factors that determine whether the company is active in the market on any day. Our Securities Trading Policy outlines periods when we do not trade Company Securities, including during blackout periods, which are outlined in Clause 15.

Other factors that influence whether the company is active in the market include, but are not limited to the following:

- Daily volumes are always considered with respect to not moving the market, and shares cannot be bought back if the market price exceeds 5% of the previous 5-day VWAP.

- Timing of ex-dividend and dividend record dates.

Whitehaven’s Security Trading Policy can be found at

www.whitehavencoal.com.au/our-business/corporate-governance/

Shares on issue

Whitehaven regularly issues a Cessation of Securities notice to the ASX to cancel shares that the company has bought back via its on market share buy-back program.

You can find the latest shares on issue by going to our ASX announcements page and searching for ‘cessation of securities’. This will bring up the latest notification to the ASX.

As at 6 January 2026, ordinary shares on issue: 826,094,519.

Within the ordinary shares on issues there are 34,020,000 WHC shares on issue that are restricted milestone shares. These shares were issued as part of the acquisition of Boardwalk Resources Pty Ltd in 2012. The milestone shares are subject to contractual restrictions on voting and transfer, and currently are not entitled to receive distributions (Restrictions). As at 6 January 2026, shares entitled to receive dividends total 792,074,519.

Important Information

Material on this page is intended only for general information and Whitehaven Coal makes no warranty as to the accuracy of this information. The material is not intended to be relied on as a substitute for your own research. We do, however, welcome your feedback and suggestions concerning any of the material. Please contact [email protected]

Whitehaven coal

Whitehaven coal