16 August 2017

Full Year Result FY2017: Record profit and distribution to shareholders

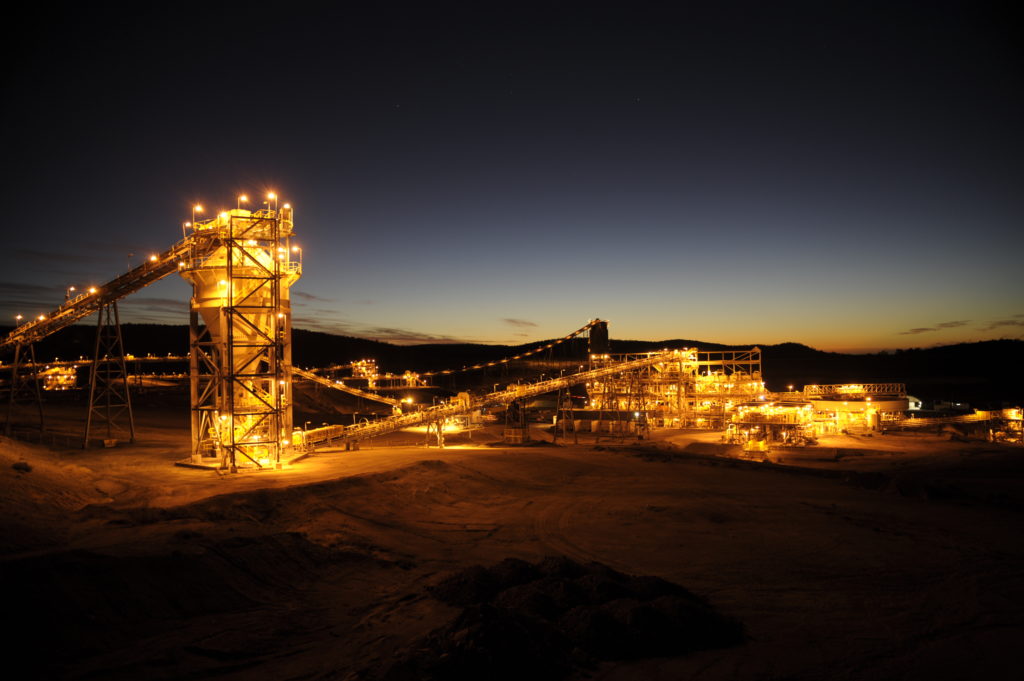

Whitehaven Coal, Australia’s leading independent high quality coal company with five operating mines in North West NSW, has reported a net profit after tax of $405.4 million for the year ended 30 June 2017.

All key financial performance metrics improved on the previous corresponding period (pcp):

- Sales revenue of $1,773.2 million, up 52%;

- Operating EBITDA before significant items of $714.2 million, up 219%;

- Cash generated from operations of $655.3 million, up 143%;

- Net debt reduced to $311.1 million at 30 June 2017 with gearing at 9%;

- Drawable debt facility of $1.0 billion refinanced into a revolver with maturity extended to 2021;

- The Board has proposed to make a distribution to shareholders of 20 cents per share; and

- As per previous guidance unit costs increased modestly to $58/t.

Operating Highlights

Managed ROM coal production and sales of coal of 23.1Mt and 20.7Mt, 13% and 3% higher respectively than the pcp reflecting the ongoing ramp up of Maules Creek mine and strong performance from the Gunnedah open cuts.

Full year ROM coal production of 9.7Mt from Maules Creek, was up 24% on the pcp. ROM coal production from the smaller open cuts was 6.1Mt, up by 6% on the pcp.

Metallurgical coal sales continue to grow in line with expectations and reached 21% of total sales for the year.

Production costs were in line with guidance of $58/t excluding royalties.

Guidance

FY2018 guidance for saleable coal production is expected to be in the range of 22Mt to 23Mt. Costs for the year are likely to increase slightly as production of metallurgical coal increases and the strip ratio at Maules Creek moves towards the life of mine ratio.

Economic and social contribution

During the year Whitehaven Coal and its Joint Venture partners made significant contributions to the economies of New South Wales (NSW) and the north west NSW region.

- $171.9 million paid to the NSW Government in mining royalties;

- $237 million spent with local businesses; and

- Made 90 donations to local community groups.

Commenting on the results, Whitehaven Coal Managing Director and CEO Paul Flynn said:

“The hard work that preceded FY2017 has been rewarded by the company reporting its highest ever profit for the year. This is a fitting result for a company celebrating its 10 year anniversary of listing on the ASX and reflects well on all of those people who have shared and participated in the journey”.

“It is also pleasing to demonstrate the confidence that the board has in the business by proposing a distribution to shareholders. The company has a strong balance sheet so shareholders can expect to receive more returns”.

“As I have said many times, Whitehaven’s high quality coal – which produces more energy and fewer emissions per tonne than almost all competing coals – is being widely and rapidly accepted in the growing Asian market”.

“The outlook for the high quality coal we produce is positive, as more HELE technology coal-fired power plants are being deployed into the Asian region”.

“The release of the Finkel report and increased debate about energy security and affordability in Australia should lead to Australia following the lead of Germany, Japan and of our customer countries – by installing HELE technology to lower both emissions and the cost of electricity for all Australians”.

Financial Performance

Key highlights

- Net profit after tax (NPAT) increased to $405.4m.

- Operating EBITDA before significant items increased by 219% to $714.2m.

- Cash generated from operations increased by 143% to $655.3m.

- Net debt of $311.1m at 30 June 2017 and gearing reduced to 9%.

| FY2017

$m’s |

FY2016

$m’s |

|

| Revenue | 1,773.2 | 1,164.4 |

| Net profit before significant items | 367.2 | 20.5 |

| Significant items after tax | 38.2 | – |

| Net profit after tax | 405.4 | 20.5 |

| Operating EBITDA before significant items | 714.2 | 224.1 |

| Significant items before tax and financing | (55.0) | – |

| Net interest expense | (42.1) | (56.9) |

| Other financial expenses | (7.9) | (9.1) |

| Depreciation and amortisation | (133.9) | (130.4) |

| Gain on disposal of assets | 0.1 | – |

| Profit before tax | 475.4 | 27.7 |

The 30 June 2017 NPAT includes the impact of the following two significant items:

- A $55.0m pre-tax impairment charge in relation to early stage exploration assets.

- Recognition of additional deferred tax assets in respect of previously unrecognised income tax losses of $76.7m.

The recognition of these items has the effect of increasing the NPAT by $38.2m. There were no significant items recognised in FY2016.

The full documents related to the results are below:

FY2017 Annual Financial Report

August 2017 Coal Resources and Reserves Update

The webcast of the Investor Conference Call can be viewed by registering at: https://edge.media-server.com/m6/p/id86vkpa

Back to News Whitehaven coal

Whitehaven coal